Financials

Full Year Financial Statement And Dividend Announcement

Financials ArchiveUnaudited Condensed Interim Financial Statements For the Three Months and Full Year Ended 31 December 2024

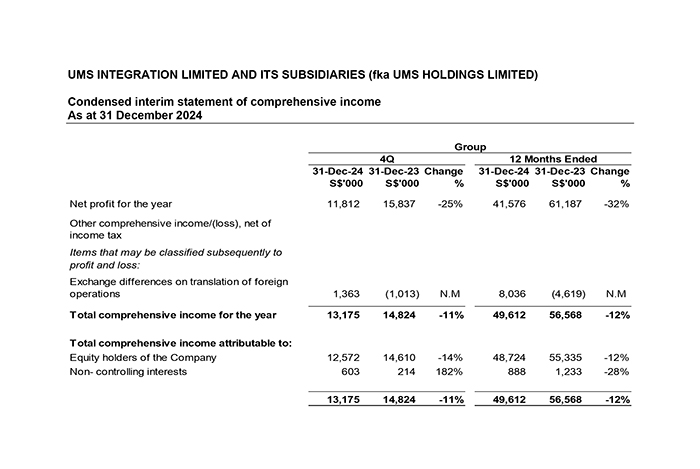

Consolidated Statement of Comprehensive Income

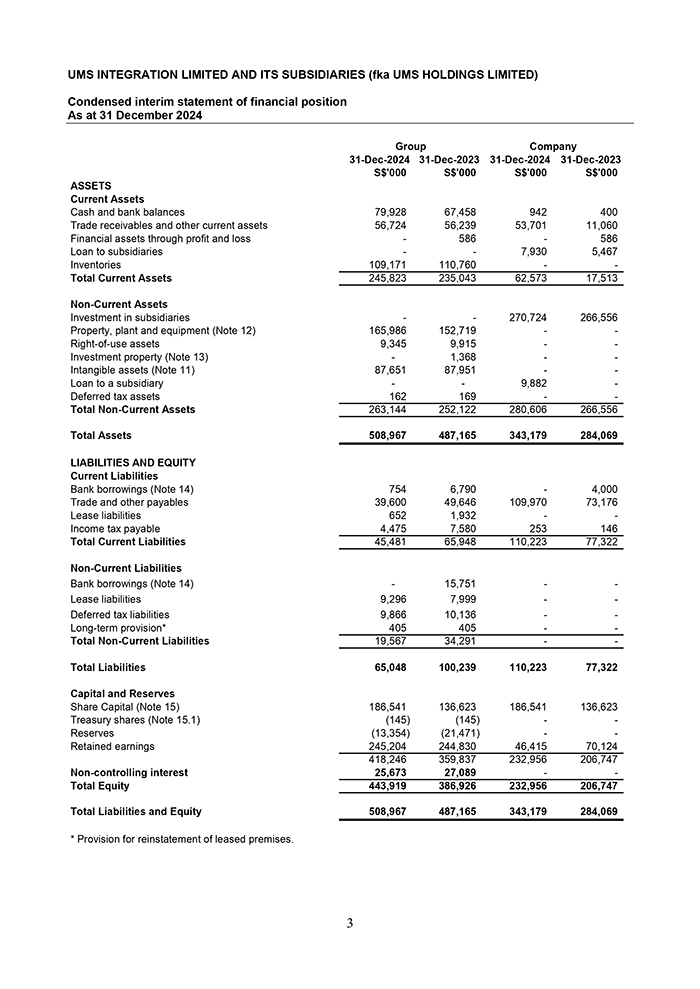

Balance Sheet

Review Of Performance

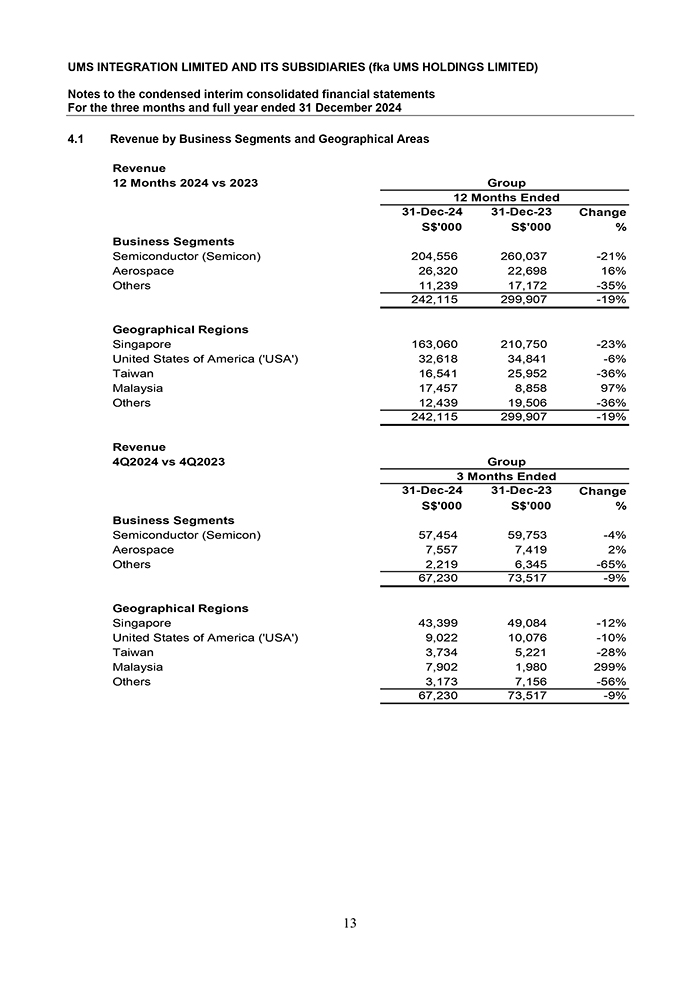

Revenue

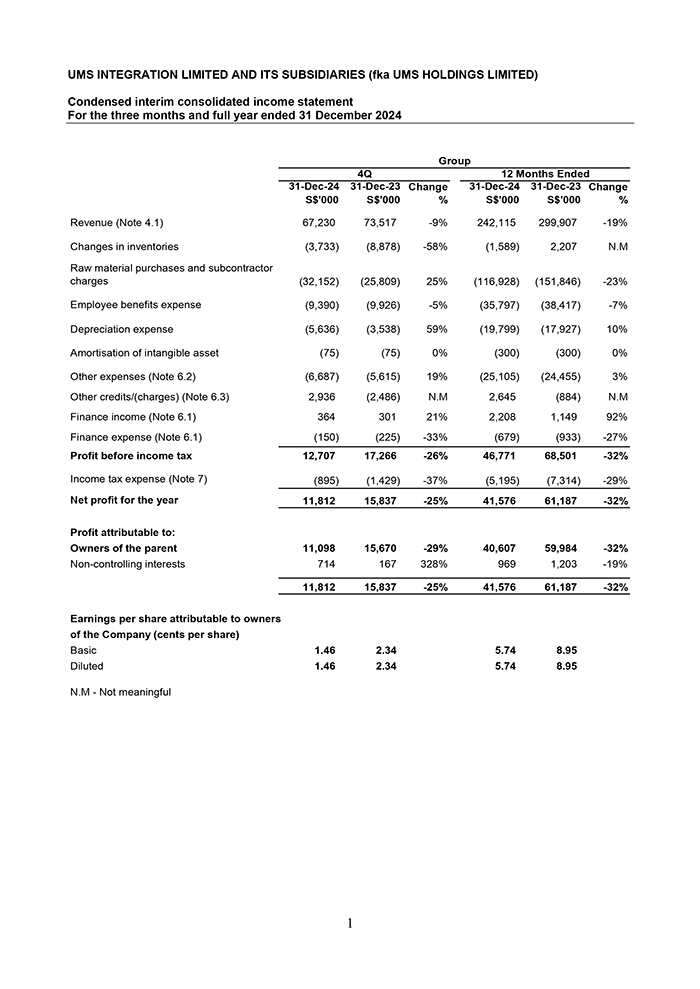

4Q FY2024

Group revenue fell 9% Y-o-Y to S$67.2 million in 4QFY2024 from S$73.5 million in 4QFY2023, but improved 4% Q-o-Q from S$64.9 million in 3QFY2024. Sales have resumed quarterly growth since 1QFY2024.

Compared to 4QFY2023, the Group's semiconductor segment sales dipped 4% while revenue in Others slumped by 65% mainly due to the weaker material and tooling distribution business affected by the general business slowdown. The lower sales in the Semiconductor segment was due to a decline in Semiconductor Integrated System ("IS") sales which fell 22% from S$32.0 million in 4QFY2023 to S$25.1 million in 4QFY2024. This was offset by higher component sales which increased 17% from S$27.8 million to S$32.4 million during the period under review.

Aerospace sales, which benefitted from the global aviation rebound, increased by 2% during the same period.

However, both the Group's Semiconductor and Aerospace reported higher sales compared to 3QFY2024.

Revenue in the Semiconductor segment grew 4% while Others eased 6%. Under the Semiconductor segment, Integrated System sales eased 7.5% while component sales rose about 16% on a Q-o-Q basis.

Compared to 3QFY2024, Aerospace sales also edged up by 1%.

Geographically, all the Group's key markets - except Malaysia - posted lower revenue in 4QFY2024 compared to the same period last year.

Revenue in Malaysia jumped 299% as the Group continued to ramp up production of semiconductor components for its new major customer.

Compared to 4QFY2023, revenue in Singapore fell 12% mainly due to lower overall semiconductor sales, while sales in the US and Taiwan decreased 10% and 28% respectively due to lower component sales in the US and lower component spares sales in Taiwan.

Sales in the Others segment plunged 56% Y-o-Y due to weaker demand in its material and tooling distribution business.

However compared to 3QFY2024, all the Group's key geographies except Singapore reported improved Q-o-Q sales. Malaysia's revenue rose 72%, US sales edged up 2%, while Taiwan and Others rose 0.8% and 2.3% respectively. Singapore sales eased 2.9%.

FY2024

Revenue in FY2024 fell 19% to S$242.1 million from S$299.9 million in FY2023 as sales in the Group's Semiconductor segment and Others segment decreased 21% and 35% respectively. The drop was moderated by a 16% rise in Aerospace sales during the period under review.

Semiconductor Integrated System sales decreased 33% to S$94.4 million in FY2024 from S$140.0 million in FY2023. Revenue from component sales fell 8% to S$110.2 from S$120.0 million during the same period.

Apart from Malaysia, sales declined in all the Group's key geographical markets.

Compared to FY2023, revenue in Malaysia surged 97% in FY2024 as orders from the new customer increased while sales in Singapore and US fell 23% and 6% respectively. Both Taiwan and Others reported sales decline of 36%.

Profitability

4Q FY2024

The Group's gross material margin declined to 47% in 4QFY2024 from 53% of 4QFY2023. This is mainly due to unfavourable exchange rate movements during the quarter caused by a weaker US dollar (USD) and a stronger Malaysian Ringgit. However, the situation turned around near year end as USD strengthened against SGD and the Group recorded a foreign exchange gain at the end of the year.

Compared to 4QFY2023, Group profit before tax fell 26% to S$12.7 million while net profit declined 25% to $11.8 million from $15.8million in 4QFY2023. Group net profit attributable to UMS shareholders decreased 29% to $11.1 million from $15.7 million in 4QFY2023.

While the Group trimmed its personnel costs by 5%, its depreciation costs leapt 59% mainly due to commencement of depreciation of the new production machinery.

The Group's other expenses also rose 19% over last year as a result of higher professional fees incurred for its secondary listing in Malaysia and higher machinery maintenance costs.

The Group's bottom line however benefitted from higher exchange gain, higher gain on disposal of fixed assets partially offset by an increase in inventory provision.

Income tax expenses also dropped 37% due to lower profits.

However, compared to 3QFY2024, Group profitability improved. Net profit and net attributable profit both grew 14.9% to S$11.8 million and 6.6% to S$11.1 million respectively while pre-tax profit jumped 6.5% to S$12.7 million in 4QFY2024.

FY2024

The Group posted lower profit in FY2024.

Net profit before tax declined 32% to S$46.8 million in FY2024 from S$68.5 million in FY2023 while net profit and net attributable profit also fell 32% to S$41.6 million from S$61.2 million and S$40.6 million from S$60.0 million respectively.

The decrease in profit was due to lower revenue as well as higher expenses. Depreciation expenses increased 10% mainly due to fixed asset additions. Other expenses also rose 3% as a result of higher professional fees for the Group's secondary listing in Malaysia, as well as higher property and machinery maintenance costs.

The Group also recorded a reversal from an other charges of $0.9 million to a credit of $2.6 million. Its bottom line benefitted from higher foreign exchange gain as well as gain on disposal of quoted investments, partially offset by lower gain on disposal of fixed assets and higher inventory provision.

Gross material margin in FY2024 improved to 51.0% from 50.1% in FY2023.

Commentary

The Group delivered a commendable performance in FY2024 - despite persistent inflationary pressures, intensifying geopolitical tensions and market uncertainties.

The Group remained profitable and continued to generate positive operating cash flow and free cashflow.

The Group's performance also demonstrates the success of its diversification strategy - as its Aerospace business continued to report robust growth, moderating the slowdown of its semiconductor business segment.

The Group's new production facilities in Penang are largely completed and operational. It has commenced volume production for its new customer, and expects significant improvement in delivery supported by strong order flow as production ramps up.

The Group is also working on several NPI (new product introductions) from its new customer as new product families are forecast to rise in the coming months.

Both the Group's two major global semiconductor customers have given positive outlook guidance for 2025 riding on the acceleration of AI investment and demand worldwide.

The semiconductor industry is expected to start 18 new fab construction projects in 2025, according to SEMI's latest quarterly World Fab Forecast report. The new projects include three 200mm and fifteen 300mm facilities, the majority of which are expected to begin operations from 2026 to 2027.1

According to the Semiconductor Industry Association (SIA), the global semiconductor market experienced its highest-ever sales year in 2024, topping $600 billion in annual sales for the first time, and double-digit market growth is projected for 2025. It also added that as semiconductors enable virtually all modern technologies - including medical devices, communications, defense applications, AI, advanced transportation, and countless others, the long-term industry outlook is "incredibly strong."2

The aviation industry is also flying high on the wings of the global boom in air travel.

According to IATA, global air passenger demand reached a record high in 2024. The number of air travellers around the world is expected to surpass five billion for the first time in 2025 as travel becomes increasingly affordable. Total revenues in the industry are set to exceed US$1 trillion for the first time this year, at US$1.007 trillion.3

Looking ahead, the Group will remain prudent in managing market volatility and business risks as well as global uncertainties while leveraging on its strong fundamentals and financial position to capitalize on these upbeat industry trends to deliver positive returns to shareholders.

The Group remains optimistic of its growth prospects, and will continue to make investments across its key business segments to support its long-term growth plans.

In view of the Group's robust performance in FY2024, the Board has decided to reward shareholders with a final dividend of 2.0 cents.

Barring unforeseen circumstances, the Group expects to remain profitable in FY2025.